If you own a business or commercial property in Garden Grove, CA, investing in solar systems can be highly advantageous. On top of federal tax credits, there are state and local incentives, permitting advantages, and cost savings that make solar a smart financial move.

Below are incentives and key local/regional considerations for Garden Grove business owners (as of late 2025), along with tips to maximize savings.

Local & Regional Incentives in Garden Grove / Orange County / California

Here are relevant programs, policies, and exemptions in Garden Grove / Orange County that affect solar for businesses:

- Property Tax Exclusion for Solar Energy Systems

- California offers a 100% property tax exclusion for commercial solar systems. That means even though installing solar increases your building’s value, that added value from the solar systems does not trigger higher property taxes. Greentech Renewables

- For a business, this helps you avoid recurring tax costs tied to the value increase due to solar, improving your return on investment. Greentech Renewables

- California offers a 100% property tax exclusion for commercial solar systems. That means even though installing solar increases your building’s value, that added value from the solar systems does not trigger higher property taxes. Greentech Renewables

- Expedited Permitting & Plan Review in Garden Grove

- The City of Garden Grove has published solar guidelines and a streamlined permitting / plan check process. The Community Development / Building Division handles plan check applications, and inspections are managed via their Building Division. ggcity.org

- Having a predictable, efficient permitting path reduces time delays and soft costs (engineering, planning, labor waiting times). This is especially helpful for commercial systems, which often require more complex structural and electrical reviews. ggcity.org

- The City of Garden Grove has published solar guidelines and a streamlined permitting / plan check process. The Community Development / Building Division handles plan check applications, and inspections are managed via their Building Division. ggcity.org

- Net Metering / Interconnection Policies

- Garden Grove falls under (or is served by) utilities in the Orange County / Southern California Edison (SCE) / perhaps Community Choice Aggregation (CCA) areas. Interconnection and net metering policies are favorable in many Orange County cities. sullivansolarpower.com+3OhmHome+3EcoWatch+3

- Business owners should verify with their utility: when a commercial system exports power, how much the utility will credit, how quickly interconnection is approved, what technical requirements are (inverters, safety, inspection). Favorable net metering improves payback.

- Garden Grove falls under (or is served by) utilities in the Orange County / Southern California Edison (SCE) / perhaps Community Choice Aggregation (CCA) areas. Interconnection and net metering policies are favorable in many Orange County cities. sullivansolarpower.com+3OhmHome+3EcoWatch+3

- State-Level Incentives & Tax Breaks

- State Property Tax Exclusion (as above) for solar: ensures no added property tax from solar value. Greentech Renewables

- California’s incentive programs such as rebates, energy storage incentives, etc., may still apply at state or utility levels. Some are targeted at disadvantaged communities or for battery storage systems. EcoFlow+1

- Note: many of the large California rebate programs for solar’s generation side have reduced or expired, especially for residential; but programs for storage (batteries), demand response, and commercial incentives may still exist or be revived. Check current state Climate or Energy Commission, or CPUC / local utility. SolarReviews+1

- State Property Tax Exclusion (as above) for solar: ensures no added property tax from solar value. Greentech Renewables

- Cost and Payback in Garden Grove

- According to EcoWatch, the average cost of a home solar system in Garden Grove after tax credits is ~$7,006 for systems sized for a typical residential use. For larger commercial systems, costs scale, but many of the same incentives apply, and the economies of scale often help. EcoWatch+1

- Also, average payback periods in Garden Grove are estimated around ~8-9 years in many cases (for residential). Commercial systems often have larger scale and sometimes higher loads, which can shorten ROI if the system offsets large electric bills. EcoWatch+1

- According to EcoWatch, the average cost of a home solar system in Garden Grove after tax credits is ~$7,006 for systems sized for a typical residential use. For larger commercial systems, costs scale, but many of the same incentives apply, and the economies of scale often help. EcoWatch+1

How These Local Incentives Combine With Federal ITC in Garden Grove for Businesses

Putting together the federal & local pieces, here’s how a business in Garden Grove might stack up:

| Incentive / Benefit | What It Provides | How It Helps a Garden Grove Business |

| Federal Investment Tax Credit (ITC) | 30% of eligible system cost can be applied to federal tax liability. | Big upfront savings. If your tax liability is sufficient, you can reduce the net capital outlay substantially. (Plus bonus or accelerated depreciation may also help.) |

| State Property Tax Exclusion | No increase in property tax due to added value from the solar installation. | If your commercial building’s property tax would otherwise rise, this saves you recurring cost. |

| Streamlined Local Permitting & Plan Review | Quicker approvals, fewer delays, less administrative cost. | Reduces soft costs; permits, inspections, structural reviews are more predictable. Helps avoid unexpected cost/time overruns. |

| Net Metering / Interconnection Policies | Ability to export excess energy, get credited, reduce bills. | Useful especially if your business has non-uniform demand (off-hours), can send energy back or reduce peaks. |

| State / Utility Rebates or Incentives | Possibly rebates, incentives for storage, demand response, etc. | May reduce initial cost, improve ROI especially if your system includes battery storage or if you qualify under disadvantaged community programs. |

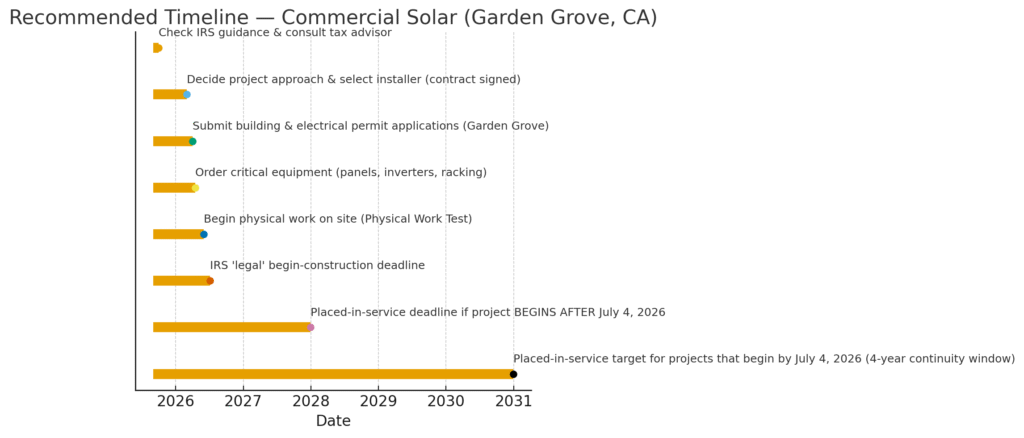

Key Deadlines & What They Mean

| Deadline | What It Requires | Why It Matters |

| July 4, 2026 | “Begin construction” on your solar or wind facility, to qualify under the exception in OBBBA. Holland & Knight+3Chapman+3Creative Planning+3 | If you begin construction on or before this date, you are in the safer bucket: more time, more favorable conditions for obtaining the full Investment Tax Credit (ITC) or Production Tax Credit (PTC). Projects after this date have stricter limitations. Holland & Knight+3JD Supra+3Creative Planning+3 |

| December 31, 2027 | Placed in service date for projects that begin construction after July 4, 2026. JD Supra+3Chapman+3Creative Planning+3 | If you start a project after July 4, 2026, it must be completed (i.e. producing electricity, operational) by this date to get the credit. If you miss this, you lose eligibility. Baker Electric+2Creative Planning+2 |

| Effective Sept 2, 2025 | For projects where construction does not begin prior to this date, new guidance (Notice 2025-42) applies regarding how to prove “beginning of construction.” Creative Planning+3Holland & Knight+3Mayer Brown+3 | After this date, for many projects, the “5% Safe Harbor” test (spending 5% of eligible project cost) will no longer be generally available for demonstrating start of construction — except in certain cases (small/“low-output” solar, ≤1.5 MW). Instead, you’ll often need to satisfy the Physical Work Test (actual physical work on site or off site under certain conditions) and maintain a continuous work schedule. Sidley Austin+3Creative Planning+3Holland & Knight+3 |

| Four-Year Window for “Continuity Safe Harbor” | If construction begins by July 4, 2026, you generally have up to four calendar years after the year construction begins to place the facility in service and still claim the credit. Holland & Knight+2Project Finance Law+2 | That gives projects a buffer: for example, if you begin construction sometime in early 2026, you may have until end of 2030 to place the system in service. But this depends on satisfying continuity requirements (keeping consistent work going, avoiding unreasonable delays). Project Finance Law+1 |

What “Begin Construction” Means Under the New Rules

Because the rules have tightened, especially under IRS Notice 2025-42, understanding what constitutes the start of construction is critical:

- The Physical Work Test: Actual physical work of a “significant nature” such as installing foundations, racking, inverters, etc. Work off-site under binding contracts that produce components may count in some cases. Creative Planning+2Holland & Knight+2

- The Five Percent Safe Harbor: Formerly, a project could qualify as having begun construction by spending at least 5% of the total eligible project cost (and meeting some other criteria). Under the new rules, this safe harbor is generally limited: only usable for small/low-output solar projects (≤1.5 MW). For larger commercial or utility scale ones, reliance on the Physical Work Test is now the primary or only option. Creative Planning+2Holland & Knight+2

- Continuity Requirement: After construction starts, the project must show ongoing work (or meet safe-harbor conditions) so there’s no “stop-start” that jeopardizes eligibility. Delays caused by permitting, supply issues may be excused under certain rules, but documentation is crucial. Project Finance Law+1

Practical Implications for Business Owners (e.g. in Garden Grove, CA)

- If you want to be safe, aim to have physical work started (or meet whichever “begin construction” test applies to your project) on or before July 4, 2026.

- If you miss that, and start after July 4, 2026, then you must make sure your system is operational (placed in service) by December 31, 2027. Otherwise, you’ll forfeit eligibility for the credit under Sections 48E / 45Y.

- For projects begun by July 4, 2026, you may have until up to four years after the year construction begins to complete (i.e. placing in service), provided you meet continuity. So, for example, if you begin construction in 2026, you might have until end of 2030 depending on exact timing.

- For smaller solar commercial installations (≤1.5 MW), the 5% Safe Harbor may still be available if you satisfy the conditions. But note: the newer IRS notice restricts that option somewhat, especially for larger systems.

- Be particularly careful with timing of contracts, procurement, and physical work. Delays (permits, supply chain, inspections) can be fatal if you cross one of these deadlines without establishing “begin construction” in a compliant manner.

What Business Owners in Garden Grove Should Watch Out for / Action Steps

To maximize benefits:

- Plan for deadlines: Make sure you begin construction in time to be eligible for the full 30% ITC at the commercial rate (check current IRS & legislative rules). If delays push you past deadlines or eligibility windows, you might lose value.

- Document everything carefully: Costs, when they occur, what components you buy, labor vs. materials, installation dates, permits. These all matter for claiming credits and avoiding recapture.

- Check component eligibility: Some recent legislation requires domestic content rules, “prevailing wage” or labor requirements, etc., for some bonus credits under the ITC. Confirm with your installer/tax advisor.

- Talk to the utility / local jurisdiction: For example, Southern California Edison (if you’re under SCE), or any CCA (if applicable), to understand interconnection and net metering, any rate schedules or demand charges that might affect your savings.

Evaluate whether adding storage is worth it: Batteries often have separate incentives; in many commercial settings, storage helps shave peak demand charges or ensure backup during outages, which improves business continuity and savings.