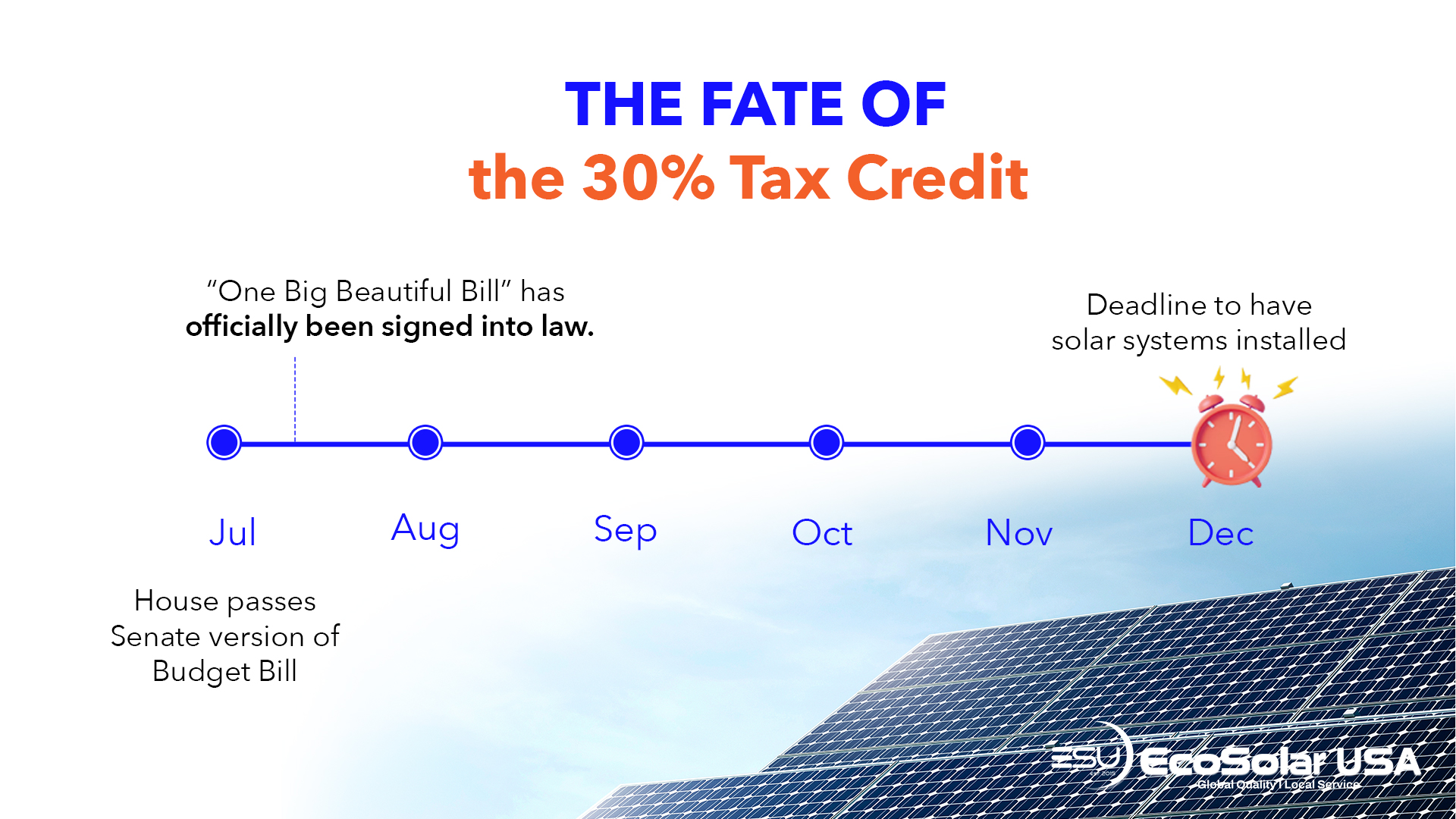

The “Big Beautiful Budget” has officially been signed into law—and with it comes a major shift that will affect millions of homeowners: the Federal Solar Tax Credit for residential systems is set to end after December 31, 2025.

Unlike past versions of the program, there is no phase-out period planned. That means starting in 2026, the residential solar credit could drop to 0%, eliminating one of the biggest financial incentives for going solar.

What’s Happening with Federal Tax Credits?

The recently passed budget legislation includes a provision to terminate the Residential Solar Investment Tax Credit (ITC) after 2025. This credit has allowed homeowners to deduct 30% of the cost of their solar energy systems from their federal taxes.

Here’s what’s changing:

- Through December 31, 2025, homeowners can still claim the full 30% credit.

- Beginning January 1, 2026, the credit will end entirely under the current law.

- There will be no gradual reduction like in previous years—once the deadline passes, the incentive disappears.

What Happens to Your Payback Period Without the Tax Credit?

The payback period refers to the amount of time it takes for the savings from your solar system to equal the initial investment.

For example:

- A $25,000 solar installation with the 30% tax credit gives you $7,500 back, lowering your net cost to $17,500.

- Without the credit, your full investment remains at $25,000, extending your payback period.

On average, losing the tax credit could add 1 to 3 years to the time it takes to break even. While the return on investment is slower, solar still delivers long-term financial benefits—especially as electricity rates continue to climb.

For Homeowners Considering Solar Energy: Is Solar Still Worth It?

Yes—solar is still a smart investment, even without the federal tax incentive.

Here’s why:

- ✅ You significantly reduce your monthly electricity bills.

- ✅ You protect yourself from unpredictable utility rate hikes.

- ✅ You increase your property’s resale value.

- ✅ You generate your own clean, renewable energy.

While financing terms may shift without the tax credit, most homeowners will still benefit from long-term savings, greater energy independence, and environmental impact.

What’s Next for Solar?

As 2025 comes to a close, it’s expected that:

- Solar demand will surge due to the expiring tax credit.

- Installation timelines may be delayed due to increased volume.

- State and local solar incentives may take on greater importance post-2025.

Homeowners who delay too long risk missing the opportunity to have their system installed and activated in time to claim the full 30% benefit.

Act Now to Secure Your Solar Savings

To take full advantage of the federal solar tax credit:

- ✅ Schedule your free solar consultation as early as possible.

- ✅ Start your permitting and design process right away to avoid delays.

- ✅ Sign your installation contract and get on the schedule before the deadline.

Special Limited-Time Offer for California Homeowners

6 Months of Free Solar Payments

- Available to qualified residential installations in California

- Must sign up by August 31, 2025

- Combine this offer with the federal tax credit for maximum savings

📞 Don’t miss your chance to save big on solar. Contact us today to get your custom solar proposal and lock in your 30% federal credit while it’s still available.